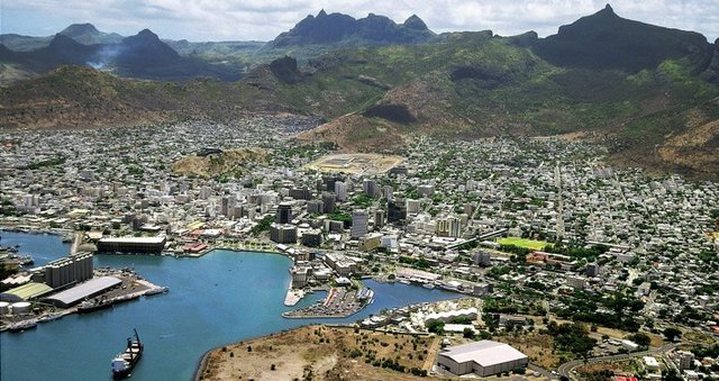

Is Mauritius A Tax Haven?

Yes. Mauritius siphons off money from countries where economic activity takes place.

Tax havens are technically called 'secrecy jurisdictions' and offer harmful structures of secrecy, tax avoidance and the differential treatment of non-nationals.

They compete on how low the tax rate can go, and some simply collect company registration fees and no tax at all.

This allows companies to fragment themselves and register shell and holding companies, and leasing and management operations, in a jurisdiction where no tax is paid, and then artificially send profits made elsewhere to the offshore fragment in order to avoid tax.

In this way, secrecy jurisdictions infringe on the rights of nationals from the country where the actual economic activities take place by denying them the rightful tax revenue of the value created there.

Despite SABMiller, Africa's largest brewer and the second-largest in the world, making profits of more than £2bn ($3.1bn) a year, in 2010 the charity ActionAid found a woman who runs a shop just outside of its bottling plant in Ghana paid more tax than the multinational.

United Kingdom-based SABMiller uses 65 tax haven companies: more than it has breweries and bottling plants in Africa.

First it stores its 'local' brands – like Castle, Chibuku and Stone – in the Netherlands, where they collect royalties with a tax loss of £10m per annum.

It pays management services fees to sister companies in Switzerland, avoiding a further £9.5m in tax in Africa and India. Then Mauritius comes in with a logistics role.

The Accra brewery in Ghana sources raw materials from South Africa but routes them through Mauritius, losing Ghana about £670,000 in tax.

Finally, using Mauritius in a 'thin cap' arrangement, the Accra brewery is kept artificially undercapitalised, in other words in debt to the Mauritian subsidiary MUBEX because interest payments can be offset against tax, losing Ghana a further £76,000 per year.

SLEIGHT OF HAND

There are two fictions being propagated by those who want to exploit secrecy jurisdictions and those marketing their services: that some secrecy jurisdictions are better than others and that their services are essential to the global economy and economic development in Africa.

It is true that secrecy jurisdictions differ in the degree of opacity they offer.

Indeed, in 2009 the Organisation of Economic Cooperation and Development tried to clean up a bit by generating a 'black list,' 'grey list' and 'white list'. But by allowing jurisdictions to sign voluntary bilateral tax information exchange agreements the 'black list' magically disappeared soon after.

Mauritius is now on the 'white list.' In truth, by providing an exceptional space for wealth to be stored, all secrecy jurisdictions provide for theft by artificially allowing companies to move profits to where they pay less tax and where the provenance of the money is largely unchecked. To say that one tax haven is better than another is to say one would prefer to be mugged at knifepoint rather than at gunpoint. ?

Sarah Bracking in KwaZula Natal Province

No. Mauritius is a low- tax jurisdiction pushing for more substance.

Mauritius's vice prime minister and finance minister Xavier-Luc Duval is emphatic: "We're not a tax haven because there is no secrecy. You can't open a bank account here without giving your full details. We are happy to exchange tax information with all our partners."

Duval defends Mauritius's right to be a low-tax jurisdiction. "Every time we've brought down the tax rates, tax revenues have increased, so it's been done for genuine reasons," he explains.

For a country like Mauritius, with no large government expenditure on the military, there is no need to overburden the population with taxation, he argues.

"What you need is economic activity and buoyancy," he says. Duval claims Mauritius is following discussions about tax havens at the Group of Eight (G8) closely, "but it has to come up with more concrete suggestions so we can look at them."

Marc Hein, chair of the Financial Services Commission, compares the 25,000 global business companies (GBC) registered in Mauritius to the 375,000 in the Cayman Islands, more than 1m in the British Virgin Islands and 125,000 in the Seychelles.

"If we had wanted to be looking at quantity rather than quality, today we could easily have been at 250,000. But we decided to do otherwise," he says.

Hein emphasises the government's policy push for companies registered on the island to have 'substance': to bring more to the economy of the island, to open substantial offices there and employ Mauritians.

BOARD MEETINGS IN SITU

The law already obliges some offshore companies – those registered as a global business company 1 (GBC 1) – to do this.

To obtain a certificate of tax residency, a GBC 1 must have two local directors, a local auditor, a principal bank account in Mauritius and board meetings held and chaired in Mauritius. GBC 2s, of which there are more, have less strin- gent requirements.

Rama Sithanen, a former finance minister who was responsible for the reforms that introduced global business into Mauritius in 1994, says this push for substance is important for Mauritius's reputation.

"It's not a question of having shortcuts. We don't do that. We can't afford to do that because we need to have our reputation in all the other sectors of the economy. Mauritius is quite unique, we're not one of these small island economies that rely for 90% of its business on global business. This is a broad-based, vibrant, fully diversified and dynamic economy," Sithanen says.

In a move to assuage Indian claims that companies are just doing 'brassplate' operations in Mauritius because of the low-tax regime, there is now a tax official sitting in the Indian embassy in Mauritius who facilitates the exchange of information.

"This exchange of information, I think, is of paramount importance," says Hein.

"Fifteen years ago we would not have accepted that, and today we accept it. We can see that we had to make concessions."