OPEC Inaction Sends Brent to Four-Year Low, Hits Stocks

With markets in the United States due to reopen following Thursday's holiday, futures on major U.S. stock indexes were steady to 0.3 percent lower.

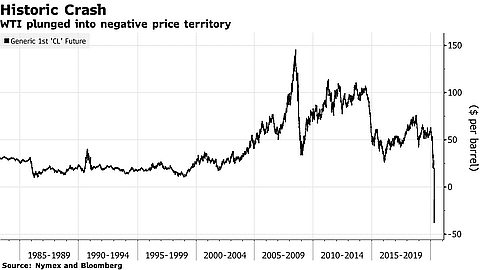

Brent crude touched a low of $71.12 a barrel after settling at a four-year closing low on Thursday, when Saudi Arabia blocked calls from poorer members of the OPEC oil cartel to cut production to stem a slide in global prices.

Europe's oil benchmark came off its lows to trade at $72.53, but remained poised to shed more than 15 percent in November -- its biggest monthly fall since for six years. U.S. crude was last down 6.5 percent at $68.90.

The slump dominated Asian and European trade.

European oil & gas stocks . dropped 4.3 percent, dragging the pan-European FTS 0.5 percent lower to 1,386.76 after a five-day winning streak.

The euro and the yen both lost ground to the safe-haven dollar, which also made dramatic gains against the currencies of oil-rich countries, rallying to as much as 7 Norwegian crowns, a high not seen in over five years.

Although a lower oil price helps support economic growth, it may undermine efforts to avert deflation in Japan and Europe.

"Whatever positive connotations lower energy might have for global growth, the extent and pace of the decline in oil seems the more worrying factor for the moment," said Michael Turner, a strategist with RBC Capital Markets.

The plunge in oil prices weighed on inflation expectations, pinning euro zone sovereign bond yields at record lows after data showed cheaper energy helped push annual inflation in the bloc back to a five-year low of 0.3 percent in November.

The reading was in line with expectations, and did nothing to counteract soft price data from Germany and Spain that suggested the ECB may come under more pressure to ramp up monetary stimulus to counter the threat of deflation.

German 10-year yields, the benchmark for euro zone borrowing, were down a fraction at 0.70 percent, while French peers were 2 bp lower at 0.98 percent.

Bonds from Italy and Spain, which trade at a large premium to Bunds and offer the greatest amount of potential for tightening if the ECB launches a full-blown quantitative easing programme, saw bigger moves.

"It's pretty clear that the vast majority of the disinflation trend has been due to oil prices ... but it is also clear that this is not a development the ECB can ignore," said Credit Agricole's senior euro zone economist Frederik Ducrozet.

The ECB is expected by many to follow Japan in buying government debt to try to vanquish deflation. On Friday, Japanese two-year government bonds traded at a negative yield for the first time in history, as the Bank of Japan's massive bond buying crushed short-term debt yields.

The dollar rose about 0.4 percent against the yen to 118.17 yen , while the euro drifted down about 0.1 percent to $1.2438 EU=. The dollar also spiked to a one-week high against its Canadian counterpart at $1.1392 and rose 0.6 percent against a basket of six major currencies .

Spot gold extended losses into a third session on expectations that plunging oil prices could sap inflationary pressure and curb the metal's appeal as a hedge. Gold was down 0.6 percent at $1,183.90 an ounce, over 1 percent lower on the week and ready to snap a three-week rally.