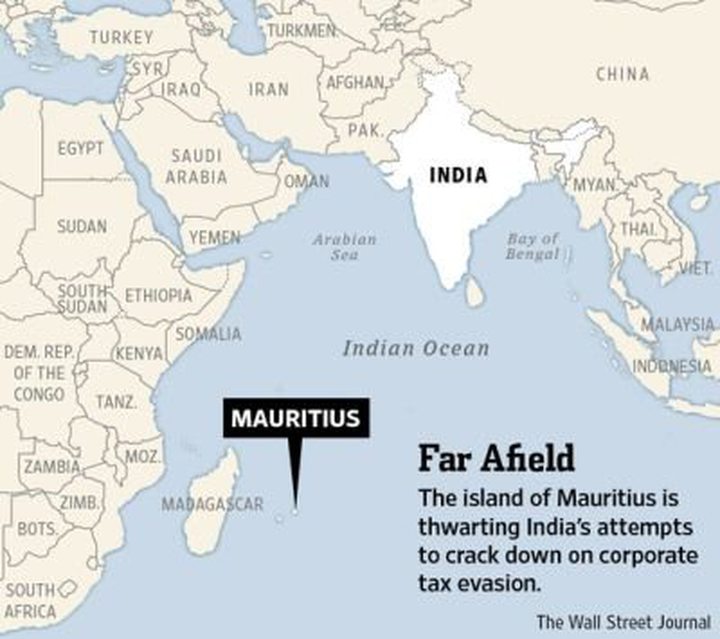

Island Tax Haven Roils India's Ways

With its white-sand beaches and sugar-cane fields, Mauritius styles itself as a Cayman Islands to India, allowing investors to slash their tax bills by channeling money that is destined there. The result: 38% of all foreign direct investment in India, or $65.29 billion, traveled through the offshore center between 2000 and May 2012, including 6% that came directly from the U.S.

The money path began in the early 1990s, when the island sought to supplement its sugar, textile and tourism industries by becoming a gateway for foreign investment. Around the same time, India, some 2,500 miles away, was opening itself to outside investment. Foreigners rushed to set up companies in Mauritius to benefit from a 1983 tax treaty with India that exempted Mauritius-based investors from capital-gains taxes.

By the end of 2010, Mauritius hosted 27,500 holding companies controlling more than $400 billion in assets. Setting up a company there takes just two weeks and $10,000, and such companies as JP Morgan Chase & Co., Citigroup, PepsiCo and most private-equity groups now have Mauritius subsidiaries.

The influx has boosted employment and living standards. About 15,000 Mauritian accountants, lawyers and other professionals work with offshore companies, representing 5% of Mauritius's gross domestic product. Glass towers housing Barclays and Ernst & Young in Ebene's new commercial district have replaced sugar-cane fields. A few parking lots and a handful of coconut trees are arrayed among the buildings, giving the area the feel of an American office park.

According to Global Financial Integrity, a Washington, D.C., research firm that seeks to reduce the illicit flow of funds internationally, India loses $7 billion a year in taxes from offshore accounts, including many in Mauritius. "At the time [of the treaty], no one imagined that India would be attracting so much foreign investment," says Maurice Lam, chairman of Mauritius's Board of Investment, an investment promotion body controlled by the Finance Ministry.

Over the past several years, the two countries have held eight rounds of talks to revise the treaty as India seeks to crack down on what it views as tax avoidance. The island has yielded to pressure in the past: China forced Mauritius to amend its tax treaty in 2007 so that investors had to pay a 10% capital gains tax in China in some circumstances. But the most recent round of talks with India ended last week with no resolution.

Certainly the savings from offshore tax planning can be enormous. In a high-profile case that didn't involve Mauritius, Indian officials argued in court that U.K-based Vodafone and a Hong Kong company had averted a more than $2 billion tax bill tied to an $11.2 billion transaction by using subsidiaries outside of India. Earlier this year, the country's highest court upheld the offshore accounting. In a statement at the time, Vodafone welcomed the ruling, saying the decision underpinned its confidence in India.

India's aggressive drive against tax avoidance echoes efforts in other big emerging markets, including China. Having become confident enough of their investment allure, they have begun to emulate tactics long used in the U.S. and Europe to challenge multinationals' complex tax schemes.

But the effort has spooked foreign investors, who pulled more than $1 billion out of India on news of a new anti-evasion law last spring. In June, rating-agency Standard & Poor's revised its outlook on India from stable to negative and warned that the country could lose its investment-grade sovereign rating if it doesn't fix its finances.

A multinational company will typically set up a holding company in Mauritius that controls a particular investment in India. When the multinational later sells the investment, it benefits from the absence of a Mauritian capital-gains tax. And because it is based abroad, it pays no Indian capital-gains tax of up to 40%. The Mauritian holding company can also shield the multinational from India's tax on dividends, which is 15%, and its 20% tax on interest payments.

Mauritius officials say that while they believe in offering low tax rates they don't condone tax evasion. India is pressing for change, negotiating tax treaties with dozens of countries and signing a new treaty last year with Switzerland, the world's largest offshore center. Its biggest foray has been challenging deals involving offshore subsidiaries, arguing that paper-only subsidiaries in places like Mauritius have too little substance to shield their parent companies from Indian taxes.

That argument was used when India challenged a $300 million sale by Dallas, Texas-based AT&T of its stake in an Indian company to two Indian conglomerates. AT&T used a Mauritius-based unit to make the sale, but the Bombay High Court ruled last year that "the investments in India were made by AT&T U.S.A. and not AT&T Mauritius." The case is being appealed, and AT&T and the two buyers declined to comment. Government officials say they haven't decided who would be responsible for the tax liabilities, which would be 20% on any capital gains.

Last spring, the Indian government drafted a statute that would give the government broad powers to override the tax exemptions of paper-only entities. But the news sent Indian financial markets skidding. After meeting with top institutional investors, the government quickly decided to delay the law's implementation until next year. A new finance minister has since indicated that the government may ease up on the new law.

Simultaneously, India has pressed for changes in the tax treaty with Mauritius, proposing that companies setting up operations there agree to capital-gains taxes ranging from 10% to 15%.

Meanwhile, island officials argue they have gone the extra mile to work with India, regulating more of the companies setting up shop and requiring more documentation. "It is sad to see that we've become a political football in India," said Xavier Luc Duval, Mauritius's vice prime minister.