Russia Must Compensate Yukos Shareholders, European Court Rules

An international court ruled that Russia owes shareholders of the now-defunct oil giant Yukos more than $50 billion for what it described as the Kremlin's "devious and calculated expropriation" of assets designed to bankrupt the firm.

The compensation award is the largest the Permanent Court of Arbitration in The Hague has ever rendered, lawyers said. But it is only half what shareholders had sought, and any attempts to collect are expected to drag on for years.

"It may be another long battle," said Emmanuel Gaillard, the lawyer who represented GML Ltd., the Gibraltar-registered vehicle formerly known as Menatep, through which Yukos's former owner, Mikhail Khodorkovsky, and his colleagues held their controlling stake.

Russia's Finance Ministry called the ruling "seriously flawed" and "politically biased" and vowed to appeal, although it was unclear how or where. Russia has also claimed the court lacked jurisdiction as Russia signed but never ratified the Energy Charter Treaty, under which the case was brought. The court ruled in 2009 that signing it was enough, so the case went ahead.

Mr. Gaillard said the arbitration ruling is final. "It has been decided and now it has to be enforced," he said.

The ruling was dated July 18 and unsealed on Monday.

Once Russia's largest oil company, Yukos was hit with tens of billions of dollars in back-tax claims starting in 2004, and its main assets were sold off to state-controlled Russian companies.

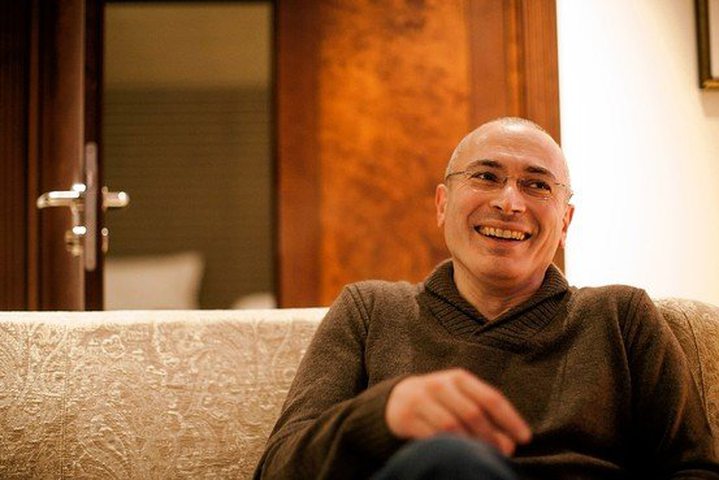

Although Russian officials maintain the case was purely a matter of tax evasion, the destruction of Yukos was widely viewed as the Kremlin's effort to crush Mr. Khodorkovsky, the company's politically ambitious chief executive officer and main shareholder. He served more than 10 years in jail for fraud and tax evasion before being released last year.

The arbitration claim was brought by two GML units and the Yukos pension fund, which together held a 60% stake in Yukos. Mr. Khodorkovsky said several years ago that he gave up his Yukos stake to his colleagues in an effort to fend off the attack on the company.

The claim was heard by three arbiters—one appointed by each side in the case and the third by the Dutch court.

"It is the tribunal's view that Yukos was the object of a series of politically motivated attacks by the Russian authorities that eventually led to its destruction," the ruling said.

The auction of core parts of the company through contested bankruptcy proceedings "was not driven by motives of tax collection but by the desire of the State to acquire Yukos' most valuable asset and bankrupt Yukos," the panel wrote. "In short, it was in effect a devious and calculated expropriation."

The panel based its compensation figure on how much the company was valued at in 2003, when the government began taking steps to take control of it. The shareholders had based their claim on a valuation of just over $100 billion for the company.

The plaintiffs now face the task of filing claims in any jurisdiction where they think they can seize Russian or Russian-related assets. Plaintiffs in similar cases have had mixed results in such attempts.

Mr. Khodorkovsky was freed in December after being pardoned by Russian President Vladimir Putin.

Mr. Khodorkovsky and his business partner, Platon Lebedev, were jailed in 2003 on charges of fraud and tax evasion and convicted in 2005. As their original sentences wound down, a second trial for embezzlement and money laundering was held in 2010 that initially resulted in their prison terms being extended until late 2016, with the terms being reduced on appeal.

The two men's trial was a watershed event in Mr. Putin's rule, seen by critics as the beginning of Kremlin efforts to stifle dissent. Mr. Khodorkovsky and his supporters proclaimed his innocence and insisted the cases amounted to political retribution.

GML is now controlled by Leonid Nevzlin, Mr. Khodorkovsky's longtime partner who lives in Israel and has been convicted of several crimes in Russia in absentia, including embezzlement, murder and attempted murder. He has denied the charges and said the cases against him were "show trials." The rest is owned by other Yukos partners, including Mr. Lebedev.

Mr. Nevzlin told Russia Ekho Moskvy radio that the shareholders would spare no cost in pursuing Russian assets.

"The shareholders are ready for the next step. If Russia refuses to pay, we will search for and freeze Russian assets around the world," he was quoted as saying.

Mr. Khodorkovsky said he was deeply satisfied by the court's ruling.

"It is fantastic that the company shareholders are being given a chance to recover their damages. It is sad that the recompense will have to come from the state's coffers, not from the pockets of Mafiosi linked to the powers that be and those of Putin's oligarchs," he said.

Russian oil giant OAO Rosneft, which took control of the bulk of Yukos' assets through a series of bankruptcy proceedings the plaintiffs have said were illegal, said it doesn't consider itself a party to the decision and doesn't believe any claim can be made against it.

"Rosneft isn't a party, isn't a participant in the suits and isn't a defendant in the announced decisions," the company said. "Rosneft believes that all the deals to purchase former assets of Yukos, as well as all of its other actions in relation to Yukos, were fully lawful and conducted in accordance with the applicable legislation."

Tim Osborne, the director of GML, said the plaintiffs were working on a strategy on how best to recover assets and suggested companies like BP PLC, which owns around 20% of Rosneft, could become a target.

"It is safe to say that nobody is safe. We will look at everything," he said.

Yukos's management has filed a separate expropriation claim on behalf of minority shareholders valued at as much as $38 billion in the European Court of Human Rights in Strasbourg, France. A ruling in that case is scheduled to be released on Thursday.