The History And Evolution of Hotel Loyalty

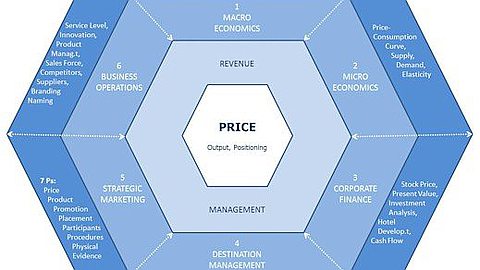

GLOBAL REPORT—Loyalty programs are a staple of hotel brand marketing and have been so for 30 years, although their scope and importance have evolved over the years and will continue to do so, sources said.

“At its core, Marriott Rewards is designed to build deeper engagement with our most valuable customers,” said Bob Behrens, VP of Marriott Rewards at Marriott International. “It gets customers to choose you beyond the rationale of price and location because they have an emotional affinity to your brands and will go out of their way to consistently stay with you.”

While expensive and complicated to design and manage, hotel loyalty programs are important in a number of ways to hotel brand companies and the owners of their hotels.

“The most obvious reason is we know from credit card studies that when a member joins our program they give us a greater share of their wallet,” said Don Berg, VP of loyalty programs and partnerships for InterContinental Hotels Group. “Ultimately, the success of any loyalty program is not whether you’re getting more business or more nights or more revenue, it’s whether you’re getting a bigger share of the wallet. We’ve proven conclusively that when a member joins the program, they give us 36% more of their share than they did the year before they enrolled in the program.”

Berg said loyalty members are three times more likely to use direct channels—the IHG website or 800 number—than are non-members, “which means they’re far more cost-efficient for the hotel owner as opposed to booking through a travel agent, an online travel (agency) or any other entity that generates a commission cost to the hotel.”

And, Berg said, the massive databases of loyalty program members gives brands highly efficient marketing platforms to reach these customers in a direct and personal way.

“If we know someone stayed with us seven times in the past year, I can create a hurdle program which says, ‘If you stay with us 10 times, I will give you a very rich offer.’ That’s opposed to putting out a broad-based offer to all members telling them if you stay seven times, you will get X,” he said.

Owners need to get involved in order to maximize the efficiency of hotel loyalty programs, said Marriott’s Behrens.

“The program is built to run effectively and efficiently so customers don’t expect a lot,” he said. “We ask GMs and owners to make sure they’re aware who their top individual clients and repeat customers are. It’s really simple, authentic recognition: taking care of the customer and putting them in the center of everything you do.”

While similar in scope and design, hotel and airline loyalty programs create different levels of engagement with their customers. While hotels focus on hospitality and the creation of good experiences, airlines are “logistically focused businesses in which loyalty (programs) help customers reduce their pain,” said Henry H. Harteveldt, travel industry analyst with consulting firm Hudson Crossing.

“It’s a perverse type of relationship,” he said of airline loyalty. “In the hotel business customers are loyal because they like something; they join loyalty programs with airlines because they hope they will hurt you less.”

One challenge hotel programs face, Harteveldt said, is the perceived value of airline rewards are much greater than what’s offered by hotels. An airline customer can save enough points to redeem a ticket for a faraway destination that, depending on its location and the type of seat, could be valued at tens of thousands of dollars. Redeeming hotel rewards might be at most a value in the hundreds or few thousands of dollars.

Starting with the airlines

Following airline deregulation in the United States in 1978, airlines were compelled to market their services more aggressively. That, combined with increased computing power and data-storage capabilities, led to the first frequent flyer program from a major air carrier, American Airlines, which launched AAdvantage in 1981. (Two years earlier, regional carrier Texas International Airlines introduced a simple mileage-based loyalty program. The program was discontinued within a year and TIA was soon acquired by Continental Airlines.)

Two brands lay claim to firsts involving frequency programs in the hotel industry.Holiday Inn launched its program in February 1983, followed by Marriott in November of the same year. Holiday Inn discontinued its program in 1986 and restarted it a year later, giving Marriott the claim as the oldest continuously operating program in the hotel space.

The first generation of hotel loyalty schemes were simply conduits to airline programs: Currency earned in hotel programs could be used toward free flights on participating airlines. Quickly, hotel loyalty evolved so rewards accrued could also be used for free roomnights and other perks.

Brand companies continue to modify and refine their loyalty schemes. Four large hotel companies—IHG, Marriott, Hilton Worldwide and Starwood Hotels & Resorts Worldwide—recently made significant changes to their points programs, raising the thresholds for members to receive free-night benefits. For example, Marriott moved some of its hotels into a higher points category, while Hilton added a 10th category to include some of higher-rated properties.

Not all hoteliers have been pleased with the changes. During its recent second-quarter earnings call with analysts, executives from Sunstone Hotel Investors said the changes to the Hilton HHonors programs is affecting performance at two of its hotels in the Times Square area of New York: the Hilton Times Square and the DoubleTree Suites Times Square.

“Some of the things that will affect our (revenue per available room) growth rate for the two products we have in Times Square is the change in the Hilton HHonors system,” said Bryan Giglia, senior VP and CFO for Sunstone. “They changed the points system, materially devalued the points program across the board, but it specifically impacted our two hotels. And while HHonors has been a fairly significant driver of room nights at our hotels in the New York market, that change has impacted RevPAR growth in those hotels in the second quarter.”

The future of hotel loyalty

“Loyalty programs in the hotel space have evolved as a reflection of larger societal trends and some unique hotel trends,” Harteveldt said.

“Many of the larger hotel loyalty brands have co-branded credit cards. We’ve also seen some brands, such as IHG and (Starwood Hotels & Resorts Worldwide), focusing on offering unique experiences. And (Fairmont Hotels & Resorts) and (Kimpton Hotel & Restaurant Group) offer not just rewards but also on-site guest recognition, such as free Wi-Fi or member-only events at their hotels. The programs have become much more than about points and tiers. They are much more lifestyle and experientially focused.”

Some brand companies have partnered with resort companies—IHG with Las Vegas Sands and Hyatt Hotels Corporation with MGM Resorts International, for example—to provide reciprocal benefits for its loyal customers. And loyalty programs are no longer just the realm of brand companies. Several options, including Voila Hotel Rewards andStash Hotel Rewards, provide loyalty options for independent and boutique properties.

Traditional chains give loyalty club members increased flexibility in how they use their currency. IHG has a concierge service, in which IHG Rewards Club members can use amerchandise catalog to exchange points for products, services and travel offers. Marriott recently struck a deal with United Airlines that provides special benefits to members in both companies’ loyalty programs.

“The industry won’t get away entirely from the points-for-stay model, but the evolution (of loyalty) will move toward recognition: who is the guest, what do they like and what are their preferences,” Harteveldt said. “The industry can, will and should get away from the gameification aspects that have plagued not just hotel loyalty programs, but the airlines as well. You’ll see hotels focus more on guest spending and the financial value the guests bring, as opposed to strictly frequency.”