Monetary Policy Committee: The key rate increases from 4% to 4.50%

Monetary Policy Committee

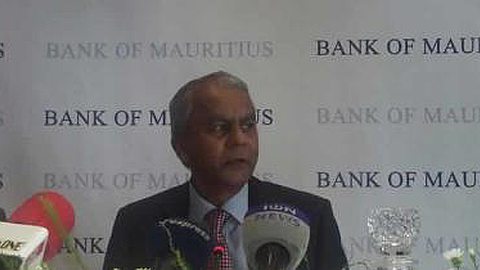

The reasons for the MPC’s rate hike are multiple, the BoM governor said. Inflation remains a threat, with a forecast of 3.7% in 2025, fuelled by global trade tensions, supply shocks and climate impacts. Excess liquidity is undermining the effectiveness of monetary policy, contributing to the depreciation of the rupee and thus increasing inflationary pressures. Despite these challenges, Rama Sithanen said, the economy is growing robustly, driven by construction, financial services, tourism and trade. He added that the hike is aimed at stabilising prices, supporting the rupee and strengthening the transmission of monetary policy. It should also allow banks to offer more attractive interest rates on savings deposits, he said.

As a reminder, in September 2024, the "key repo rate" had seen a decrease of 50 basis points, from 4.5% to 4%. This decision had been taken by the MPC under the chairmanship of the former governor, Harvesh Seegolam.

The next MPC meeting will take place on May 7.