Nigeria Piques Global Chains’ Interest

Lagos—one of the fastest growing cities in Africa, according to City Mayors—has seen a swell of new openings and developments as global hotel chains look to capitalize on demand from the significant number of regional and intra-African trade operations headquartered in the city. In addition, Lagos has an important seaport activity related to its crude oil exports.

Exports in Nigeria grew by 15% from 2011 to 2012 with crude exports accounting for two-thirds of the country’s annual total, according to National Bureau of Statistics. Europe was the largest beneficiary of crude oil (37%).

Imports, on the other hand, have continued to grow from Asia and China in particular, the agency said.

This economic growth had some positive outcomes on real estate, particularly with regards to land and real estate prices. Knight Frank’s “Africa Report 2013” shows that prime yield in Lagos is between 9% for residential and 13% for industrial real estate. The report also points out that an executive four-bedroom residence rental reaches $10,000 per month—the highest in the continent.

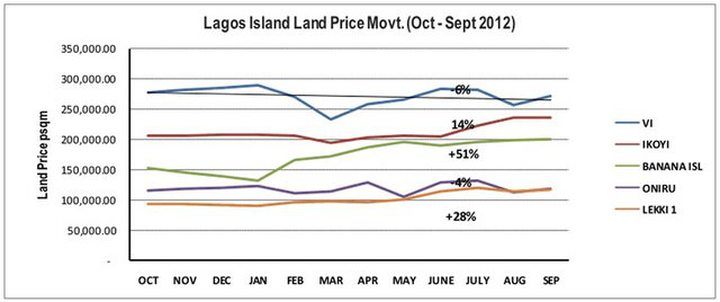

Land prices on Victoria Island, the most desired area in Lagos, reached $1,753 per square meter during 2012, according to a report from MCORE’s Real Estate Investment Report. The Banana Island area experienced the largest increase in land value (+51%) in 2012.

Hotel performance

Hotel demand in Lagos increased 7.3% during 2012, according to data from STR Global, sister company of HotelNewsNow.com. Supply growth during the same period was up 6%.

During the first two-months of 2013, supply growth remained relatively unchanged, while demand increased 13.6%.

With increased competition in the Lagos hotel market, average-daily-rate growth in local currency has remained fairly unchanged during 2012 and first quarter 2013. Occupancy during 2012 was up only 1.3%, although during the first quarter of the year the metric jumped 12.2%.

Abuja, the second largest hotel market in the country, has seen little change in hotel supply since 2010, according to STR Global data. Year-to-date March demand growth decreased 1.3%. However, compared with Lagos, year-to-date occupancy in Abuja saw a decline (-1.2%). Even with a slight decrease in occupancy during the first quarter, ADR in local currency increased 5.8% during the same period.

(see pic above)

Pipeline growth

A number of new hotels opened during 2012 in Lagos, including:

- the Four Points by Sheraton Lagos;

- the Ibis Lagos Airport; and

- the Radisson Blu Anchorage Hotel, Lagos, V.I.

Further growth is expected from the likes of Carlson Rezidor Hotel Group, Hilton Worldwide, InterContinental Hotel Group, Starwood Hotels & Resorts Worldwide, Hyatt Hotels Corporation and Protea.

Hotel supply is likely to grow by 61.4% in Lagos and 26.7% in Abuja, according to STR Global’s February 2013 pipeline data.

W Hospitality, meanwhile, expects approximately 5,000 rooms to open in Lagos by 2017. The largest concentration of new openings will occur in the Ikeja neighborhood (a 44.3% increase projected in new supply), followed by Victoria Island (+34.6%).

However, existing operators shouldn’t feer the surge in supply, according to W Hospitality:

“Our experience has shown that construction delays and funding often reduce the number of projects being fully delivered. We estimate that only 25% of the pipeline is considered to be ‘definite’ for completion,” according to Trevor Ward, managing director of W Hospitality, in an email.

In addition to traditional business-oriented hotels, a number of smaller-scale projects also have been announced in Nigeria, such as the two boutique properties from Mantis Hotels.

Challenges

One of the challenges hotel operators and developers face in the market is the delay in projects and the risk that some of the pipeline will never be released.

These delays, according to W Hospitality, can be attributed to:

- lack of proper planning from the inception of the project;

- lack of focus from the developer;

- underestimating the likely total cost of capital;

- lack of professional project manager on the development team;

- late engagement of the management company; and

- lack of available capital, with projects commencing without the total funding in place.

These challenges from an investor standpoint can be explained in part by bank lending rates in Nigeria remaining very high (above 20%) compared with other markets, according to MCORE. High interest rates are the result of tight monetary supply, structural inefficiencies in the market, high costs of doing business and investment risks.

It’s not surprising that most new developments are driven toward the top end of the market, which offers high ADRs, a relatively good margin on the bottom line and a steady stream of global travelers lured by well-known brands. Developing within strict guidelines of the latter’s standards can prove challenging in the emerging region.

Also challenging is finding the skilled workers to run the hotel once it’s open.

Opportunities

Despite such challenges, Nigeria offers tremendous opportunities for hotel operators, particularly as a first (or second) step in Sub-Saharan Africa. The region is poised to grow, as long as the country can remain fairly safe for conducting business. Both macro and microeconomic indicators show positive trends, and historical hotel performance shows the potential of the Nigerian market might outweigh some of the obstacles.

Time is likely to reward those who took on a first-mover-advantage strategy, as competition remains limited in this part of Africa. The development of low-cost airlines operating within Africa and improved connections from the Middle East carriers is likely to support the hotel sector on the long term.