Why Japan Is Bad For The World

I’ve detailed previously how Japan’s efforts are likely to have terrible domestic economic consequences, whether they succeed or not. Today, I’m going to explore the latter idea: that Yen depreciation will benefit other countries as they’ll depreciate their own currencies, which will make their economies more competitive too. This idea, put forward by some serious financial commentators, is laughable as it ignores both history and any sense of simple logic. The implications are worth exploring though as competitive currency devaluations have already begun and are likely accelerate from here.

Better figures, but…

First, let’s provide some context by looking at recent events in Japan. Over the past week, Japan released GDP figures for the first quarter of 2013 which showed growth of 0.9% from the previous quarter, versus expectations of a 0.7% rise. Annualised, GDP grew 3.5%, the fastest in a year, and topped a 1% rise in the fourth quarter of last year.

Ironically, Japan 3.5% annualised growth in the first quarter crushed most other developed countries, including the U.S., where there’s supposed to be meaningful recovery going on (it recorded 2.5% growth).

Looking under the hood at Japan’s figure though, the result wasn’t that impressive. That’s because the GDP figure is a real figure, rather than a nominal one. Adjusted for a larger than expected GDP deflator (a measure of domestic prices) of -1.2%, nominal GDP grew 0.4% from the previous quarter, less than analyst expectations of 0.5%.

On the positive side though, private consumption and exports did trend up. Consumption rose 0.9%, as expected, and was up for a second consecutive quarter. This suggests that consumers may be buying into Abenomics (the nickname for the Japanese Prime Minister’s new policies) and willing to spend more. Exports also contributed 0.4% to GDP as they benefited from a 30% decline in the Yen since November last year.

Separate figures gave contradictory signals as to whether Japanese businesses are buying into Abenomics. Machinery orders in March increased 14% from the prior month, or 2.5% from the previous year. This beat expectations for growth of 3.5% and -4.9% respectively. The machinery orders figures ran counter to earlier numbers which showed capital spending for the first quarter declined 0.7%.

All in all, the economic data show mild improvement. Whether there’s a sustained future bounce is the big question. There are two things that will indicate whether Japan’s policies are starting to have a real impact: rising inflation and wages. Both haven’t happened yet and the latter especially is critical to policy success.

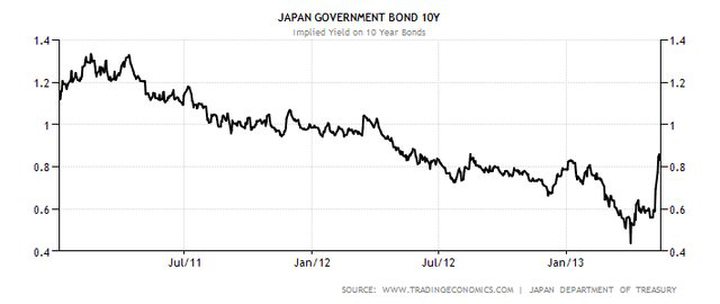

Bond yields spike

The other interesting action of the past week has been in Japan’s bond markets. Japanese government bonds (JGBs) have had a spectacular sell-off over the past week. Yields on 10-year JGBs rose by half of its value at one stage. This was despite buying from the Bank of Japan (BoJ) of government bonds ranging from 1 to 10 years to the tune of 1.2 trillion yen (US$12 billion).

The economic bulls argue that rising bond yields mean the economy is starting to normalise and that the Bank of Japan (BoJ) is succeeding in its aim to spur inflation (which will drive yields higher).

The bears suggest that increasing yields are a terrible sign as they mean liquidity in bonds is drying up as the market becomes increasingly controlled by a single buyer, the BoJ.

Either way, the BoJ is now buying 70% of new government debt issuance and that is likely to increase going forward. The government can’t allow bond yields to rise as this will mean interest on government debt rises too. Japan is in an unenviable position on this front as interest on government debt already consumes more than 25% of government revenue. A further sharp rise in bond yields will be a disaster.

While it’s clear that the BoJ can partially control the bond and equity markets (it’s buying stocks too), it has less direct control over the currency market. The yen has had an extraordinary tumble since the new government came to office in December. With more money printing to come, the yen is almost certainly heading much lower though. That’s despite being clearly oversold in the very short-term.

Yen decline is good for Europe?

A conscious decision to devalue the yen may or may not work in Japan (I’ve argued the latter for some time). But a related question is whether that decision is good for countries outside Japan.

I have addressed this question briefly before. But I thought it was worth going into some more detail given the issue has garnered more debate over the past month.

In particular, there’s been an argument gaining traction in serious economic circles that the yen’s decline will be good for other countries as it will force them to print money in order to lower their own currencies and remain economically competitive. This is particularly the case for European exporters, such as Germany, which are being hurt by the rising competitiveness of Japanese exporters due to the lower yen.

U.S. economics professor, Tim Duy, makes the case:

“… this [yen depreciation] is exactly what the global economy needs right now. If Germany and by extension Europe experiences weaker growth, European policymakers will need to respond. And they are not likely to respond by buying Yen to hold its value up. They are likely to respond by stimulating their domestic economy directly via easier monetary policy and, hopefully, easier fiscal policy.

In other words, successful domestically-orientated policy in Japan will have second-round effects that will induce further policy easing [in] Europe. And a good kick in the pants in Europe is exactly what we need right now. Rather than thinking about Japan’s policy as triggering “competitive devaluations”, think of it as triggering “coordinating global easing.”

And an assistant U.S economics professor, David Beckworth, similarly argues:

“The ECB [European Central Bank] may ease to keep the Euro from getting too expensive and in the process shore up European domestic demand. How ironic it would be if Abenomics were to accomplish in the Eurozone that intense human suffering could not: moving the ECB to forcefully act.”

I cannot think of a more preposterous and dangerous idea than that being put forward by these seemingly eminent individuals. Let’s put aside the idea that countries are made stronger by weakening their currencies, which history has refuted time and time again.

No, let’s focus instead on drawing out their argument to its logical conclusion. If Europe abandons austerity (which it has never really pursued) and prints money to significantly weaken its currency, this would start to equalise the competitiveness of the likes of German exporters against Japanese exporters.

In other words, Japan’s exporters are gaining global share at the moment vis-à-vis the Europeans due to its lower currency. These gains would reverse if Europe depreciates its own currency.

Naturally, the Japanese wouldn’t be happy with this at all. They would print more money to accelerate the depreciation of the yen. The Europeans would again retaliate upon losing export share. And so it would go on. Overall, any gains through currency devaluation would be short-lived.

But that’s not the end of it. If you assume that other countries follow Europe in devaluing their own currencies, then the whole world would be after lower currencies. This would be of little benefit to Japan. Put simply, Japan’s policies depend on other countries not following their lead.

It’s not hard to see a currency fight turning more nasty. If Japan can’t gain an advantage from deliberate yen depreciation, it’s likely to try other means. Those other means include increased tariffs and/or trade sanctions. Once this happens, global trade would be hit and everyone would lose.

The above discussion has left aside the real reason for Japan’s currency deprecation: to import inflation. A declining yen makes imports more expensive, thereby potentially inducing higher inflation. That’s what Japan is targeting. I’ll leave this issue for another day though.

When does retaliation begin in earnest?

This brings us to the issue of when the rest of the world will begin to react to Japan’s policies in earnest. Of course, some countries have already reacted. Recently, South Korea and Australia surprised with interest rate cuts. Switzerland and New Zealand have moved directly to cap their currencies. And Thailand and the Philippines are looking to move soon. It’s clear that Japan’s weak yen policies are already having a large impact on other countries.

Other major exporting countries such as Germany and China are clearly worried. Both have expressed concerns about Japan’s policies as their own respective currencies have strengthened considerably, particularly in yen terms.

If you’re like me and expect the yen to continue to decline over the next 12 months, it won’t be long before so-called currency wars start to intensify. And unlike the economic ideologues who think that everyone will win when this happens, I think the reality is likely to prove very different.