Warren Buffett: My Company Won't Leave the U.S.

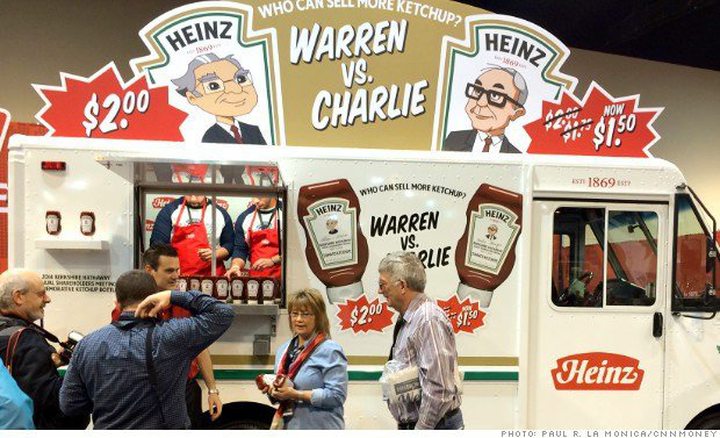

1. Pass the ketchup, please

Warren Buffett said that Heinz was a reasonably run food company before Berkshire teamed up with 3G Capital to buy the ketchup king. He noted that Heinz had pre-tax margins of 15%.

But Buffett added that he thinks the company's profit margins will "significantly improve" under Heinz CEO Bernardo Hees and that the company will be able to rein in costs without cutting into marketing expenses.

2. Should have bought more banks

Buffett said he was very happy with how well Berkshire's top holding, Wells Fargo, has done since the market bottomed in 2009.

But in hindsight, he wished that he bought even more shares of banks that fared worse during the credit crunch. That's because many of them have rebounded even more sharply.

3. High on the HOG

Berkshire Hathaway bought $300 million in debt from motorcycle maker Harley-Davidson back in 2009. The loan has paid out handsomely. It was done at an interest rate of 15%.

The deal is widely acknowledged as helping keep Harley afloat during the Great Recession. But Buffett said he should have bought the stock as well. Shares are up 566% since Berkshire made its investment.

4. The Geico gecko isn't going anywhere ...

There was an interesting question about whether Geico's business model would be disrupted if self-driving cars become the norm in the future. Buffett admitted that it could be a threat. But he said there was no scenario he could envision that would lead Berkshire to sell Geico.

5. ... and neither is Berkshire

One shareholder asked Buffett and Berkshire vice chairman Charlie Munger if they would ever consider moving Berkshire outside of the U.S. if it meant savings on its tax bill.

The question was tied to speculation that a key reason why drugmaker Pfizer wants to buy rival AstraZeneca is so that Pfizer could move its corporate headquarters to the United Kingdom and take advantage of lower taxes in AstraZeneca's home base.

Both Buffett and Munger shot down the notion of Berkshire ever leaving the United States. Each of them said they are not trying to hide from taxes ... especially since both admitted that they wouldn't have become as wealthy as they are now outside of the U.S.