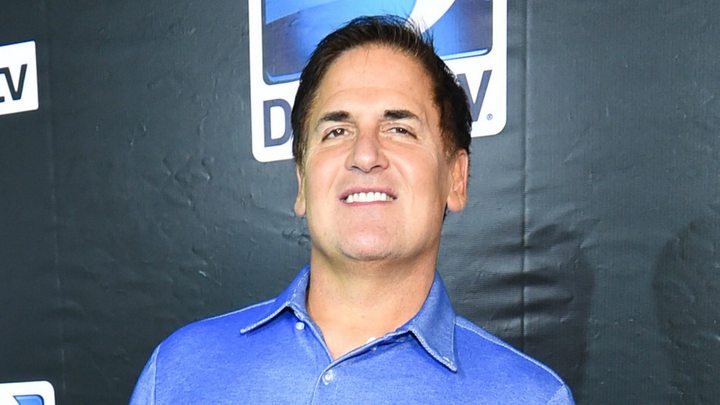

Mark Cuban Says this Tech Bubble is Worse than the One in 2000

Mark Cuban

The crux of Cuban's argument is that in 1999-2000, the bubble was inflated by public companies that at least offered investors some liquidity.

From his post on Wednesday:

Back then the companies the general public was investing in were public companies. They may have been horrible companies, but being public meant that investors had liquidity to sell their stocks.

The bubble today comes from private investors who are investing in apps and small tech companies.

Cuban isn't the first to argue that the bubble is ready to pop, but he has more credibility than many. He sold his company, Broadband.com, to Yahoo for $5.7 billion in 1999, just before the dot-com crash. After that, Cuban diversified his wealth from the acquisition to limit his exposure to the market downturn.

The Shark Tank investor draws a parallel to the original dot-com crash. "Just like back then, there were always people telling you their idea for a new website or about the public website they invested in, today people always have what essentially boils down to an app that they want you to invest in," he writes.

Another factor, Cuban writes, is that the Securities and Exchange Commission is trying to create rules that would let small-time investors underwrite tech startups.

"[T]here is no reason to believe that the SEC will be smart enough to create some form of liquidity for all those widows and orphans who will put their $5k into the dream only to realize they can't get any cash back when they need money to fix their car."