Budget 2014: Taxes Which Will Affect Your Wallet

Consumer products down

Consumer products manufactured or produced locally such as tea, milk, butter, cheese, curd, honey, soy, ham, rice, meat and sausages, will no longer be exempt from VAT but are ' zero-rated '. Producers and other traders will be refunded the VAT incurred, which may bring down the prices of these products.

Similarly, the Minister announced that tariffs will be eliminated on several products such as tea, spices, flour, salt, edible oil, margarine, toilet paper, soap, doors and windows , paint, metal bars, furniture, and other products imported from African countries as part of the SADC.

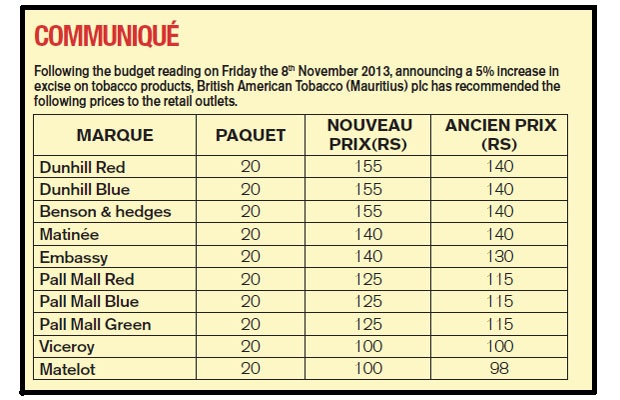

Cigarette and alcohol

As for alcoholic beverages and cigarettes, the selling price will be increased by 5% from this morning.

However, motorcycles with a cylinder capacity of 201 to 250 cc will not be taxed at 45% excise duty. Vehicle taxation based on the rate of carbon emissions will be reviewed from today. Also, the transfer fee on vehicles will be increased by 30% from today, with the exception of rights on the transfer of a motorcycle not exceeding 250cc.

Rs 1 to pay more per liter of fuel for the replacement bus

To prevent further accidents Sorèze type, Finance Minister urging motorists to exercise national solidarity. They will be charged a fee of one rupee on the sale of each liter of petroleum products for the replacement buses. Moreover, VAT will be abolished on bus chassis for easy replacement.

Housing

Owner or prospective owner of apartment or house will be exempt from VAT for an amount not exceeding Rs 300,000, depending on the building for the first time a house or an apartment whose cost does not exceed Rs 2.5 million. However, the monthly income of the family should not exceed Rs 50,000.

In addition, from 1 January 2014, the Land Transfer Tax will be struck at the uniform rate of 5% instead of 10% on the sale of property held for less than five years.

Income Tax

The taxation threshold increases by Rs 5000. As a result, families will save about Rs 750 annually on the amount of tax payable.

Energy equipment

In terms of energy-consuming equipment, they will be hit with an excise duty of 25%. Among these include the household air-conditioners, electric lamps and dry cloths. VAT will also be removed on photovoltaic cells to encourage the use of renewable energy in the context of Maurice Ile Durable project.