Perfect Partner: Why Mauritius Is an Attractive International Finance Centre

Mauritius, long known as the premier platform for inward investment into India, is increasingly used for Africa-related transactions. The current African boom has been well-documented, including impressive rates of growth and rising foreign direct investment. Opportunities abound in numerous jurisdictions and in a wide variety of sectors such as natural resources, agriculture, infrastructure, energy, mining, telecommunications, logistics, trade and tourism.

Lawyers in particular should be aware of the potential benefits of a Mauritius structure in the context of Indian and African investments. Relevant contexts to be borne in mind include investment holding, private equity and funds, with related areas including banking and finance (including aircraft finance) and insurance.

The country is among the leading sources of foreign direct investment into India. The strength of the double taxation avoidance (DTA) treaty was a boon to investment into India as the country enjoyed robust economic growth particularly since the turn of this century.

Recent statistics indicate that a growing proportion of Mauritius global business (ie offshore) companies are Africa-focused. The continent is now accounting for more than half of new global business companies in Mauritius, the figure being 58.5% for companies established in December 2013.

Commercial considerations

Mauritius is a unique international financial centre with strong cultural and commercial ties with Africa, Europe, India and China. A bilingual (English/French) country, strong democracy and model of stability (politically, economically and socially), Mauritius was ranked first in Africa (and 20th worldwide) in terms of 'ease of doing business' by the World Bank's 'Doing Business 2014' report. It also topped the Ibrahim Index of African Governance from 2007 to 2013.

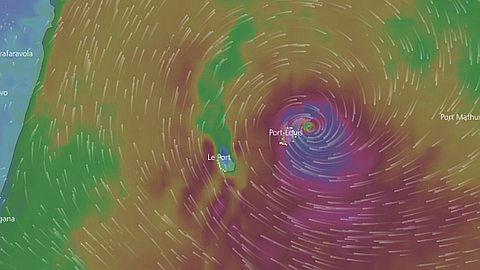

Mauritius is located between Africa and India, and is geographically an African country, with a convenient timezone (GMT+4). It belongs to key African regional organisations (providing among other potential benefits preferential access to African markets), notably the African Union, the Common Market for Eastern and Southern Africa (COMESA), the Indian Ocean Rim Association for Regional Cooperation and the Southern African Development Community.

Well-regulated, with a track record of compliance with international standards and best practice, the country is particularly strong in human capital, with a pool of professional service providers available at a reasonable cost.

Fiscal features

In addition to commercial advantages, the success of Mauritius in the Indian and African contexts as an international finance centre is also based on its fiscal strengths. It has a favourable tax regime as there is no capital gains tax, no withholding tax and no capital duty on issued capital. It has 39 DTA treaties in place including with major jurisdictions such as the UK, the United Arab Emirates, France, Germany and the People's Republic of China, as well as several African countries.

For India, the strong DTA treaty remains in place, although it is being renegotiated and, during this process, there has been a degree of uncertainty with respect to structuring investments into India. Based on ongoing discussions between Mauritius and India regarding substance and related requirements, it is likely that the updated treaty will contain some form of 'limitation of benefits' clause (as is the case with the Singapore-India treaty).

Mauritius is among a handful of countries with a wide range of DTA treaties with African countries. It has entered into advantageous treaties with Botswana, Lesotho, Madagascar, Mozambique, Namibia, Rwanda, Senegal, Seychelles, South Africa, Swaziland, Tunisia, Uganda, Zambia and Zimbabwe.

Treaties with Republic of Congo, Egypt, Gabon, Kenya and Nigeria have been signed (and are awaiting ratification). A treaty awaits a signature with Ghana, and further treaties are under negotiation with Algeria, Burkina Faso, Malawi, Morocco and Tanzania.

Advantages of the DTA treaties in the African context include:

- African nations typically levy withholding tax on dividends paid to non-residents at rates of 10%-20%. Mauritius tax treaties usually limit the withholding tax on dividends, with DTA treaty rates generally being 0%, 5% or 10%.

- Capital gains taxes in African countries are often around 30%-35%. The Mauritius DTA treaties typically provide that capital gains are taxed in the country of residence of the seller of the assets. Mauritius does not tax capital gains obtained by a Mauritius company, and therefore significant tax savings may be available by using a Category 1 Global Business Company (GBC1, further explained below) to structure an investment into Africa.

Legal system

Lawyers structuring transactions involving Africa should be reassured by the protections offered by Mauritius' strong legal system, which can help to minimise risk. This is particularly valuable for jurisdictions involving an above-average level of risk – but which offer tremendous potential rewards. Noteworthy features of Mauritius also include the lack of exchange controls and the availability of free repatriation of profits and capital.

Mauritius has a hybrid legal system consisting of the common law and the French Napoleonic Code, although the Privy Council of the UK is the final court of appeal. There is, for example, modern and flexible company/commercial legislation. The Financial Services Commission (FSC) of Mauritius oversees the regulation of its non-banking financial services industry.

A new international arbitration centre is also a potential forum to resolve Africa-related disputes in particular.

Bilateral agreements

Mauritius has also entered into various Investment Promotion and Protection Agreements (IPPAs) with several African countries. IPPAs typically provide, among other things: guarantee against expropriation; free repatriation of capital and investment returns; structure to settle disputes between investors and contracting state; and most favoured nation rule regarding treatment of investment, compensation for loss due to war, armed conflict, riot etc.

Mauritius has signed IPPAs with numerous African countries, six of which are in force (Burundi, Madagascar, Mozambique, Senegal, South Africa and Tanzania). Additional IPPAs would of course be instrumental in providing comfort to foreign investors looking to conduct business in an IPPA country.

Global Business Companies

Mauritius investment business is generally carried out through 'Global Business Companies'. There are two types, each involving a licence from the FSC: the Category 1 Global Business Company (GBC1) and Category 2 Global Business Company (GBC2). Only GBC1s are able to benefit from the treaty network.

A GBC1 may undertake a broad array of activities, including but not limited to investment holding, asset management, credit finance and other financial business. A GBC1 is tax resident in Mauritius and benefits from its extensive DTA treaty network. Income earned by a GBC1 is taxable at a maximum effective rate of 3%.

As indicated above in the African context, a GBC1 may be valuable in the context of capital gains as well as when dividends, royalties and interest are generated in the treaty jurisdiction (and transmitted to the GBC1). The treaty network is an advantage of Mauritius vis-a-vis other traditional offshore jurisdictions.

A GBC2 is suitable for activities such as asset/investment holding, consulting, marketing and international trading. It cannot engage in banking, financial services, provision of registered office facilities or directorship services. A GBC2 is not subject to tax in Mauritius; however – unlike the GBC1 – it cannot benefit from the tax treaty network.

Investment structure and jurisdictional links

A typical investment structure involves a GBC1 in Mauritius acquiring shares of an entity – for example, a local operating company – in Africa or India. Operating profits are transferred to Mauritius as dividends or interest, and an exit gain realised through disposal of assets and/or shares (generally giving rise to capital gains).

The shares of the GBC1 are often held through a company established in the British Virgin Islands (BVI) or the Cayman Islands (or directly by an entity established in a jurisdiction with which Mauritius has a DTA treaty). For example, the BVI is commonly used where joint venture partners wish to structure their shareholding and commercial arrangement in a neutral environment with advanced corporate legislation.

Another context in which BVI is useful is where third-party finance is involved and the parties wish to benefit from BVI's regulatory and commercial court regimes for matters relating to security, insolvency and enforcement.

Mauritius as a financial centre is also becoming more widely utilised in jurisdictions such as China, where BVI and Cayman structures are understood and appreciated. Chinese state-owned enterprises and other companies have been investing into Africa with great interest, and are beginning to become aware of the advantages offered by a Mauritius and related structure.

Particularly noteworthy is the growing interest in the Middle East for African investments. Dubai is a regional leader for trade, transport, tourism, logistics and financial services, with a sophisticated and well-developed infrastructure. As such, it is playing an instrumental role in business with Africa, and increasingly in conjunction with Mauritius. In particular, it is common for corporate groups and investment managers to base their African platform operations in Dubai, frequently through structures involving BVI or Cayman and Mauritius entities.

This is facilitated by Dubai having the same timezone as Mauritius. COMESA, for example, focuses on developing an extensive and accessible trading bloc for investment. It has taken steps to promote its trading ties and relationships with the United Arab Emirates.

Mauritius, in conjunction with BVI and Cayman (as well as Bermuda, for example in the realm of insurance), offers a wide variety of vehicles that may be suitable to benefit from regional investment opportunities. Vehicles include limited partnerships (of particular interest in the private equity context), protected cell companies, trusts and foundations.

In the African context in particular, it seems we are witnessing the start of an exciting and enduring new investment proposition, for which Mauritius is likely to continue to play an integral role.