Arvin Boolell: “Agalega has 80% of the world’s proven oil reserves and 17% of natural gas”

Arvin Boolell

>The prime minister’s mission to India was successful in the sense that he brought back an Rs18 billion loan that would not increase public debt. What do you have to say to that?

The prime minister has taken us for a ride. This is not the first time that India has offered a line of credit. Let me remind you that in 2015, when the Indian prime minister came here, he offered the same US$500 million line of credit. Except that it was meant for infrastructural projects and petroleum storage and bunkering, which never took off.

>There was a line of credit; the government did not take it then, now they will. So where’s the problem?

The question is: Do we need the line of credit? There is an excess liquidity in our banks on the local market. Besides, the loan we have got is not concessionary…

>You mean the 1.8% interest rate is not concessionary?

No, it isn’t. If you refer to the standards established by the International Monetary Fund (IMF) and the World Bank, the quantum of concessions has to be above 35% for the loan to be considered concessional. If you compute the inbuilt grant, the loan given by India amounts to 25% only.

>But the loan won’t be counted as public debt, will it?

It will be counted as public debt! And this is not the first time that this government is using redeemable preference shares as a gimmick. They used the same stratagem for Heritage City to buy financing without including it in the public debt. However, if you refer to the IMF statements in the past, you will see that they consider redeemable preference shares as debt and not as equity. It is true that the State Bank of Mauritius (SBM) is not counted as a public enterprise, but if the government guarantees it, it will have to be. There is no way to avoid that.

>Be that as it may, the Indians are willing to finance a major project at the rate of 1.8%. Is that not good news for the country?

It’s not good news! When you have excess liquidity in your local market, is there a need to get money from overseas. And what impact will it have on the rupee? There is no point in masking the truth by saying that this will not impact the public debt, or that the impact will be minimal. At the end of the day, someway or somehow, somebody will have to pay!

>Even if the government had opted for mopping up the excess liquidity on the market, we would still have to pay, wouldn’t we?

Yes, but there is a world of difference between borrowing in local currency and in foreign currency. The government is playing games with redeemable preference shares, the Special Purpose Vehicle and the terms of the shares, so there are many questions that remain unanswered. The fact remains that the total public debt has exceeded 68%! It is very dangerous.

>With respect, when you were in government, you never worried about public debt, did you?

The difference between them and us is that we invested a lot in the port, road construction, airport, dam, social housing etc. Mention one project that this government has invested in? In spite of all the projects we delivered, we still made sure that public debt was kept at reasonable levels, below 60% of GDP. With this government, public debt is sky high as it is, without a single project being initiated. Now, when you take on board the amount of compensation that the government has to pay to companies that are suing it, the debt will become uncontrollable.

>Isn’t that hypothetical?

It is not. Ministers and former ministers now agree that there were alternative ways to handle the British American Investment (BAI) saga than opting for expropriation and nationalisation. So we will all have to pay the consequences.

>We still don’t know what the courts will decide, do we?

I am not a lawyer, but the government knows it’s losing the battle and that’s why they are losing ground. All these are additional burdens on the taxpayers put by a government that has acted very irresponsibly. Former Minister of Good Governance Roshi Bhadain clearly stated that it was the former minister of finance, Vishnu Lutchmeenaraidoo, and the governor of the Bank of Mauritius, Ramesh Basant Roi, who had decided to revoke the licence of the former Bramer Bank. And when the licence was withdrawn, the whole conglomerate collapsed with all the effects we see today.

>That’s all well and good, but of what relevance is that today?

It is very relevant because who will bell the cat! It is the taxpayers who will bear the brunt of this government’s irresponsibility. All this will add to public debt. The government was hell-bent on damaging institutions that allegedly had links with the previous government. It all boils down to a political vendetta and the financial consequences are very far reaching.

>We are talking about a loan that’s given by India to help in the development of Mauritius and to create employment. Just what is wrong with that?

Everything is wrong with that. First, was there a need for the government to go on a borrowing spree? No. Secondly, there is liquidity which even the central bank is saying it is difficult to mop up. If the government had honesty of purpose, it would have borrowed locally or convinced some local players to invest.

>But the local banks are not willing to invest in the project!

Precisely because the project is not viable. So, why would the banks be willing to invest in it?

>When you were spearheading the light rail system, you didn’t look at viability, did you?

The project that the previous government was keen to see implemented was carefully thought out. If you read the reports of consultants looking into that project, it was crystal clear that it was a viable one. What this government is trying to implement is not a light rail; it’s a tramway and we all know that they are cutting down the elevated structures because they want to bring down cost. What will happen? It will create massive traffic congestion. The original project was designed to be rapid, transporting the population clustered between Curepipe and Port Louis and there would not have been so many transit points. The tramway they are proposing is a disaster.

>But when you were going to build the light rail system, you were also going to borrow money from India, weren’t you?

In this particular case, the interest rate was very low, less than one per cent. Now it is much higher and we don’t know what India expects in return.

>What do you think it expects in return?

There’s no such thing as a free lunch. No country runs as a charity. Elected people have constituents and they have to try their best to recoup their investment. I expected the prime minister to say loud and clear what concessions were granted to India in return for the loan.

>What worries you in all this?

Mauritius is a sovereign state and we cannot trade that for security and defence. And second, it’s important to take on board that we are signatory to the Pelindaba Treaty that says that the Indian Ocean should be a zone of peace and closed to vessels that are nuclear powered. Well, I listened to the prime minister and he said that port facilities would be extended to India. This has to be clearly defined.

>What exactly are you afraid of?

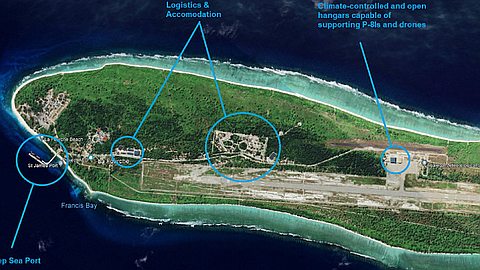

The questions I don’t have an answer to. A memorandum of understanding was presented in cabinet seven months ago by the minister responsible for outer islands. What was in it? A request by India to access facilities on Agalega island with the objective of constructing a military port? Why did two ministers express concern about that? The memorandum was not withdrawn but kept in abeyance. Pravind Jugnauth should say that no facilities will be given to India for a military port.

>What India is saying is that they will build a runway and a jetty, that they may have a few soldiers there for security reasons. Is that considered a military presence?

I also would like to know what that means precisely. There is an urgent need for the prime minister to make a clear statement that there will be no military port. There is no problem learning from India on the sharing of intelligence. In Seychelles, there is an anti-piracy unit that has the support of the EU and other friendly countries. I have no problem with a similar thing with India. But no facility should be extended to ANY country, including India, with the purpose of having a military presence on our soil.

>If India builds a runway and a jetty in Agalega island, what should it have in return?

You shouldn’t forget that we have allowed India to conduct hydrographic studies in our exclusive economic zone and India has a comparative advantage. India today has become a force to be reckoned with in maritime studies. When it comes to extending facilities, we will give India first choice, but that does not mean that India should create the impression that everything is allowed. Our territorial integrity is sacrosanct.

>Rumour has it that the Indians know that there is oil in the waters surrounding Agalega. Is that a possibility?

India has information on the basis of the hydrographic studies it has conducted. This area that stretches from the Mozambique channel to Agalega has tremendous potential for oil exploration. If I refer to an article by a geostrategic specialist, Kaplan, it has 80% of the world’s proven oil reserves, 17% of natural gas and 40% of traffic in oil and natural gas. So why do we want to create unnecessary tension? India and China are vying for a position in the Indian Ocean, and it’s true also to state that India is concerned by China’s rise. That’s why it has entered a defence agreement with the US.

>Are you one of those who say that we tend to over-romanticise our relations with India?

We do have affinities with India, from people to people contacts and economic diplomacy and we have always strongly backed India on issues which are of prime importance to them. But then India has become an emerging force and is putting a lot of emphasis on Made in India and consolidating its relations to get a bigger market and Africa has a burgeoning middle class, so they want relations there. And, naturally, it looks at its own interest first. When it comes to the Double Taxation Avoidance Agreement (DTAA), India did not walk down memory lane and said that the treaty helped channel foreign investment into India through Mauritius at a time when there were foreign exchange controls. There was a time when India had to pledge gold to the IMF to get a loan and a lot of money went into India via Mauritius. The Indians placed their own interests first as anybody else would.

>Out of all of the Indian ambitions you have mentioned: oil, Africa, Agalega, competition with China… which is likely to go against the interests of Mauritius?

We have to be the friends of everyone and enemies of none. We should not be perceived to be giving an undue advantage to India. We should give the impression of a level playing field and parity of esteem.